Credit Smart: Guide to Credit Scores, FICO, and Loan Qualification

Whether you’re looking to secure your first major loan, refinance a mortgage, or simply need to improve your financial standing, mastering your credit is essential. Your credit profile is the gatekeeper to major financial opportunities, influencing everything from the interest rate on your car loan to the rent you pay for an apartment.

In this comprehensive guide, we will break down the fundamentals of credit, teach you how lenders assess risk, show you the specific actions that instantly improve your credit score, and provide a roadmap for successfully obtaining the loan you need.

The Fundamentals of Applying for Credit

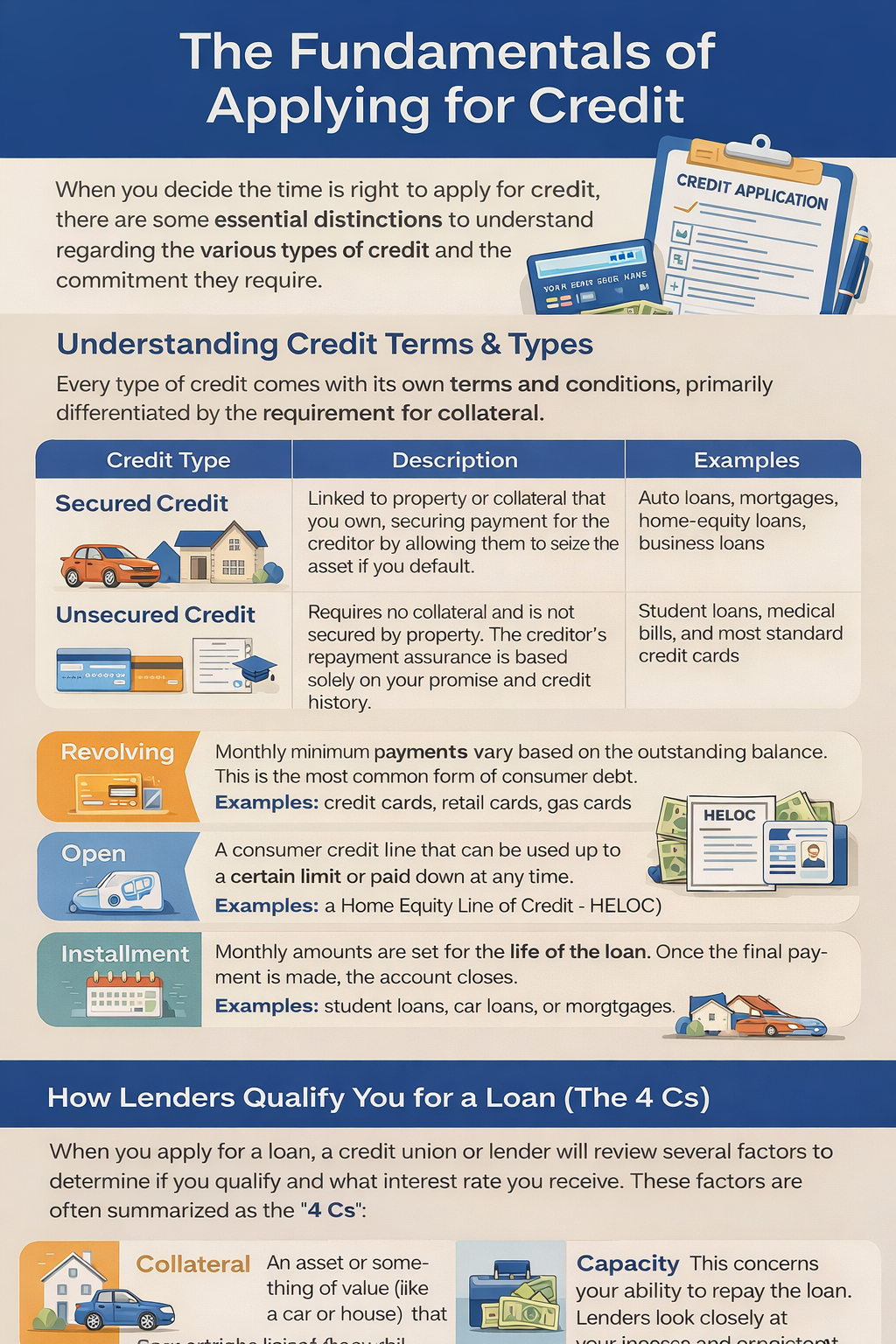

When you decide the time is right to apply for credit, there are some essential distinctions to understand regarding the various types of credit and the commitment they require.

Understanding Credit Terms & Types

Every type of credit comes with its own terms and conditions, primarily differentiated by the requirement for collateral.

| Credit Type | Description | Examples |

|---|---|---|

| Secured Credit | Linked to property or collateral that you own, securing payment for the creditor by allowing them to seize the asset if you default. | Auto loans, mortgages, home-equity loans, business loans. |

| Unsecured Credit | Requires no collateral and is not secured by property. The creditor’s repayment assurance is based solely on your promise and credit history. | Student loans, medical bills, and most standard credit cards. |

Beyond collateral, credit can be categorized by the repayment structure:

- Revolving: Monthly minimum payments vary based on the outstanding balance. This is the most common form of consumer debt. (e.g., credit cards, retail cards, gas cards).

- Open: A consumer credit line that can be used up to a certain limit or paid down at any time. (e.g., a Home Equity Line of Credit – HELOC).

- Installment: Monthly amounts are set for the life of the loan. Once the final payment is made, the account closes. (e.g., student loans, car loans, or mortgages).

How Lenders Qualify You for a Loan (The 4 Cs)

When you apply for a loan, a credit union or lender will review several factors to determine if you qualify and what interest rate you receive. These factors are often summarized as the “4 Cs”:

- Collateral: An asset or something of value (like a car or house) that a lender can take if you fail to repay the loan. This applies specifically to secured credit.

- Capacity: This concerns your ability to repay the loan. Lenders look closely at your income and consistent payment history. If you carry a lot of existing debt or have an uneven work history, lenders will view these factors as risk.

- Character: Lenders want to know if you are trustworthy. The primary measure of this is your credit record—a history of paying bills on time shows that you are responsible with your finances.

- Credit Score: This numerical measure of risk (FICO/VantageScore) provides a snapshot of your financial responsibility. A high score will create opportunities for future credit; a low score will severely limit them.

Evaluating Your Credit Report: The Financial Record

Before applying for any line of credit, you must take time to review your credit report. This report is used by a loan officer in making a decision to extend credit, tracking your success in managing credit responsibly.

What Your Credit Report Contains

A credit report, compiled by the three major credit bureaus (Equifax, Experian, and TransUnion), contains four major sections:

- Identifying Information: Your name, address, Social Security Number, date of birth, and employment. These factors are not calculated in your score but are used to verify your identity and determine your capacity to repay.

- Trade Lines: This is the core of the report. Creditors report on every account you have established: student loans, credit cards, mortgages, etc. Each lender reports the date the account was opened, your credit limit or loan amount, the current account balance, and—most importantly—your complete payment history.

- Inquiries: A list of everyone who accessed your credit report within the last 2 years. This lists both:

- Soft Inquiries: Inquiries that do not affect your credit score (e.g., promotional checks, employer verification).

- Hard Inquiries: Inquiries that do affect your credit score (e.g., applying for a credit card, mortgage, or car loan).

- Public Record and Collection Items: Information collected from state and county courts (though less common since 2018), and information on overdue debts sent to collection agencies. Public records historically included bankruptcies, foreclosures, suits, tax liens, and judgments.

Obtaining and Disputing Errors

The Fair Credit Reporting Act (FCRA) requires each of the nationwide consumer credit reporting agencies—Equifax, Experian, TransUnion—to provide you a free copy of your credit report, at your request, once every 12 months.

To order your free annual credit report, visit: https://www.annualcreditreport.com.

Disputing Credit Report Errors: If you find mistakes on your credit report—outdated, incorrect, or duplicate information—you have the right to dispute that information. Not disputing inaccurate information will lower your credit score and make it difficult to qualify for a loan.

Under FCRA, credit bureaus are required to:

- Complete an investigation within 30 days of receiving your complaint.

- Contact the creditor reporting the incorrect information within 5 days of receiving your complaint.

- Review all relevant information or facts involved in a dispute.

- Remove all inaccurate and unverified information.

To dispute an error, you must contact the credit bureaus directly:

| Bureau | Phone | Address |

|---|---|---|

| Equifax | 800.685.1111 | P.O. Box 740241, Atlanta, GA 30374 |

| Experian | (See website) | P.O. Box 2002, Allen, TX 75013 |

| TransUnion | 800.888.4213 | P.O. Box 2000, Chester, PA 19022 |

Understanding Your Credit Score (FICO Model)

Your credit score is the single number used by creditors to determine the risk level and interest rate they offer you. The most common scoring system, Fair, Isaac and Company (FICO), is used among most creditors and credit bureaus.

Factors Used to Calculate Your Credit Score

The FICO Score ranges from 300 to 850 points. Understanding how these points are allocated is the “secret” to improving your score.

| FICO Category | Points Allocated (Approx.) | Weight (%) | Actionable Advice |

|---|---|---|---|

| Payment History | 193 Points | 35% | Always pay credit cards and loans on time. One late payment can drop your score by as much as 20 points. |

| Outstanding Debt | 165 Points | 30% | Reduce your debt amount. Never carry more than 35% of your outstanding card balance (Credit Utilization Ratio). |

| Length of Credit History | 82 Points | 15% | Do not close accounts older than 7 years that are in good standing—it will lower your score. Avoid opening and closing accounts quickly. |

| New Credit/Inquiries | 55 Points | 10% | Do not sign up for credit offers you do not plan to use. More than 4 hard inquiries in a 3-month period will lower your score. |

| Types of Credit | 55 Points | 10% | Having both an installment loan (mortgage/car) and a revolving loan (credit card) will help build credit diversity. Limit revolving accounts to 1-3. |

Improving Your Credit Score: Actionable Steps

Credit scoring is not static; it changes monthly. Even if you have poor credit, following these steps can rebuild and significantly improve your score:

- Prioritize Payment History: Make all loan and credit card payments on time for 6 months. This action alone could raise your score by more than 20 points.

- Aggressively Reduce Balances: Focus on paying down your credit card balances. Paying down balances by 35% can raise your score by more than 20 points. Example: If you owe $2,230, paying $780 alone can trigger a score increase.

- Maintain Old Accounts: The age of your credit history matters. Pay off credit cards rather than transferring balances and never close old accounts that are in good standing.

Score Decreases:

- Missing monthly payments can decrease your score by 75–125 points.

- Maxing out your credit cards (reaching close to the credit limit) can decrease your score by 20–70 points.

Preparing to Get the Loan: Your Action Plan

Knowing your credit score and history is just the first step. Getting the best interest rate requires strategic preparation.

The 6-Step Loan Readiness Checklist

- Review Personal Finances: Determine how much you can truly afford to pay towards a loan. Do you have a down payment? What are your current savings? How long are you looking to finance?

- Track Monthly Expenses: You cannot evaluate your personal spending habits without tracking your spending. Review total amounts spent on variable expenses like transportation, clothing, and entertainment.

- Review Your Credit Report: Obtain your free credit report. Review your report meticulously for outdated, duplicate, or incorrect information and dispute it immediately.

- Pay Down Debt Strategically: After reviewing your outstanding debts, begin paying off small debts entirely and aim to pay down larger credit card balances by at least $\text{35}$ percent.

- Evaluate Your Credit Score: Review the credit scoring variables: Are you making late payments? Are you carrying high credit card balances? Do you open and close accounts? Take a few months to focus intensely on improving your score before applying for a loan.

- Credit Counseling and Debt Management: If you have been denied credit or need significant help managing credit card debts, nonprofit credit counseling agencies can help review your report and potentially set up a Debt Management Plan (DMP) that consolidates payments and reduces interest rates.

The Mechanics of Interest Rate Determination

While your credit score is the primary “price tag” for your loan, interest rates are determined by a combination of personal risk and broader economic data. Lenders use risk-based pricing to set your APR.

- Credit Score Tiers: Moving from a “Fair” to “Excellent” tier can save you tens of thousands of dollars in interest over the life of a mortgage or auto loan.

- Loan Duration: Generally, shorter loan terms (e.g., a 15-year vs. 30-year mortgage) carry lower interest rates but higher monthly payments.

- The Macro Economy: Federal Reserve policies and inflation trends set the “floor” for interest rates, which lenders then build upon based on your specific profile.

- Collateral Quality: Secured loans (backed by an asset) almost always offer lower rates than unsecured personal loans or credit cards.

Strategic Credit Utilization Management

Credit utilization—the ratio of your reported balances to your total limits—is often the fastest way to swing your score. It accounts for 30% of your total FICO score.

- The 35% Threshold: To avoid a score penalty, never use more than 35% of your available limit. However, those with “Ultra-High” scores (800+) typically keep utilization under 10%.

- The Statement Date Secret: Most banks report your balance on the “Statement Closing Date,” not the “Due Date.” To keep utilization low, pay your bill a few days before the statement closes.

- Utilization Sensitivity: Unlike late payments, which stay for 7 years, utilization has “no memory” in most models. If you pay off a large balance, your score can recover in as little as 30 days.

Establishing Credit: The “No-History” Roadmap

For those with a “thin file,” the goal is to prove to lenders that you can handle recurring debt responsibly without overextending.

- Secured Entry Points: A secured credit card—where your deposit equals your limit—is the most reliable tool for beginners.

- Piggybacking: Being added as an Authorized User on a long-standing account of a family member can instantly “import” years of positive history to your report.

- Modern Reporting: Use 2025-compliant services to report your utility and rent payments, which provides a “bridge” for lenders to see your consistency before you have a traditional credit card.

Debunking Costly Credit Myths

Misinformation can lead to actions that accidentally damage your score. It is vital to separate financial fiction from reality.

- The “Soft Pull” Myth: Checking your own credit through apps or official sites does not lower your score. Only “Hard Inquiries” from lenders during a loan application have an impact.

- The “Carry a Balance” Fallacy: You do not need to pay interest to have a high score. Paying your balance in full every month is the most effective way to build credit.

- The Income Misconception: Your salary is not a factor in your credit score. While income matters for “Capacity” (the ability to pay), your score only reflects your “Character” (the history of paying).

Credit’s Role in Major Life Transitions

Your credit profile is no longer just for bank loans; it has become a “financial resume” used by various industries to gauge your reliability.

- Housing & Utilities: Landlords use scores to determine security deposit amounts, and utility companies may waive deposits for those with high scores.

- Employment Screenings: Many employers, particularly in finance or government, review credit reports to assess a candidate’s level of responsibility.

- Insurance Premiums: In many states, auto and home insurance companies use “credit-based insurance scores” to help set your monthly premiums.

When to Hit “Pause” on Loan Applications

Timing is everything. Applying for credit during a “weak” phase in your history can result in a denial or predatory interest rates.

- The 60-Day Rule: If you have missed a payment in the last two months, wait. The impact of a late payment is most severe in the first 90 days.

- The Inquiry “Clumping” Effect: If you have opened two or more accounts in the last six months, your score may be temporarily suppressed.

- The Error Buffer: Never apply for a major loan (like a mortgage) until at least 30 days after you have confirmed that all errors on your report have been successfully disputed and removed.

The Blueprint for Long-Term Credit Health

High-level credit health is the result of systems, not one-time efforts.

- Automation: Set every account to at least the “Minimum Payment” via autopay to ensure you never suffer a 100-point drop from a missed deadline.

- The Annual Review: Treat your credit like a physical check-up. Once a year, download all three reports from AnnualCreditReport.com to look for identity theft or reporting glitches.

- Strategic Age: Keep your oldest accounts open, even if you don’t use them frequently. The Length of Credit History accounts for 15% of your score and is the hardest factor to “fix” quickly.

How to Build Credit from Scratch ?

If you have never used credit before, lenders have no data to evaluate you. Building credit starts with creating small, positive payment records over time.

Beginner steps to build credit:

- Open a secured credit card with a small deposit

- Use the card for one small purchase per month

- Pay the full balance before the due date

- Keep utilization below 30%

Consistency for 3–6 months is enough to generate a usable credit score.

First Credit Card: What Beginners Should Choose

Not all credit cards are beginner-friendly. Choosing the wrong card can lead to high fees and debt.

Best options for first-time borrowers:

- Secured credit cards

- Student credit cards

- Cards with no annual fee

- Cards that report to all three credit bureaus

Avoid cards that require high fees or promise “instant approval” without disclosures.

How Rent and Utility Payments Help Build Credit

Many beginners don’t realize that everyday bills can help establish credit history.

Credit-building payments include:

- Rent payments (when reported)

- Utility bills through reporting services

- Phone and internet bills

- Subscription payments tied to a credit card

On-time payments over time show reliability—even without loans.

How Long It Takes to Build Credit (What to Expect)

Credit building is gradual, not instant.

Typical beginner timeline:

- 1 month: Account appears on credit report

- 3 months: Score begins forming

- 6 months: Eligible for better cards and small loans

- 12 months: Strong foundational credit profile

Missing payments resets progress, so patience and consistency matter.

Beginner Credit Mistakes to Avoid

Early mistakes can damage credit for years.

Avoid these common errors:

- Maxing out your first credit card

- Missing even one payment

- Applying for multiple cards at once

- Closing your first account too soon

- Ignoring your credit report

Good habits in the first year make long-term credit success much easier.

FAQs

What is a good credit score?

A FICO score above 740 is good. Scores over 800 are excellent. Lenders offer the best rates to people with scores in this range.

How often can I get a free credit report?

You can get one free report from each of the three major bureaus (Equifax, Experian, TransUnion) every 12 months. Go to annualcreditreport.com.

Do soft inquiries hurt my credit score?

No. Soft inquiries, like checking your own score or employer checks, do not affect your score. Only hard inquiries from loan applications do.

How long do negative items stay on my credit report?

Late payments stay for 7 years. Bankruptcies stay for 7 to 10 years. Collections and judgments also stay around 7 years.

Will closing old credit cards help or hurt my score?

It usually hurts. Closing old accounts shortens your credit history and can raise your utilization ratio. Keep old accounts open if they are in good standing.

How fast can I improve my credit score?

You may see improvements within 1–3 months by:

- Paying all bills on time

- Reducing credit card balances below 35% utilization

- Disputing inaccurate credit report information

Significant improvements typically take 6–12 months of consistent effort.

Credit Smart – Knowledge Check

Test your understanding of credit scores, reports, and loan qualification.